Search Results

4 items found for ""

- How Changing Mortgage Rates Can Affect You

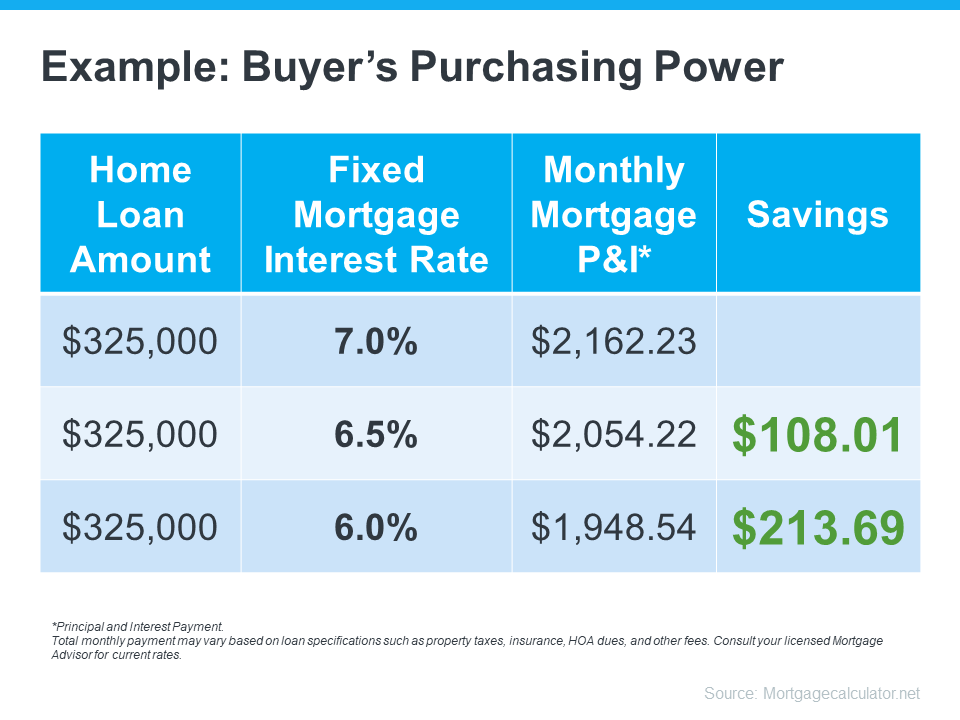

How Changing Mortgage Rates Can Affect You The 30-year fixed mortgage rate has been bouncing between 6% and 7% this year. If you’ve been on the fence about whether to buy a home or not, it’s helpful to know exactly how a 1%, or even a 0.5%, mortgage rate shift affects your purchasing power. The chart below helps show the general relationship between mortgage rates and a typical monthly mortgage payment: Even a 0.5% change can have a big impact on your monthly payment. And since rates have been moving between 6% and 7% for a while now, you can see how it impacts your purchasing power as rates go down. What This Means for You You may be tempted to put your homebuying plans on hold in hopes that rates will fall. But that can be risky. No one knows for sure where rates will go from here, and trying to time them for your benefit is tough. Lisa Sturtevant, Housing Economist at Bright MLS, explains: “It is typically a fool’s errand for a homebuyer to try to time rates in this market . . . But volatility in mortgage rates right now can have a real impact on buyers’ monthly payments.” That’s why it’s critical to lean on your expert real estate advisors to explore your mortgage options, understand what impacts mortgage rates, and plan your homebuying budget around today’s volatility. They’ll also be able to offer advice tailored to your specific situation and goals, so you have what you need to make an informed decision. Bottom Line Your ability to buy a home could be impacted by changing mortgage rates. If you’re thinking about making a move, let’s connect so you have a strong plan in place.

- Two Reasons You Should Sell Your House

Why you should call Loni Lueke to sell your house today! Wondering if you should sell your house this year? As you make your decision, think about what’s motivating you to consider moving. A recent survey from realtor.com asked why homeowners are thinking about selling their houses this year. Here are the top two reasons (see graphic below): Let’s break those reasons down and explore how they might resonate with you. 1. I Want To Take Advantage of the Current Market and Make a Profit When you decide to sell your house, how much you’ll make from the sale will likely be top of mind. So, here’s some good news: according to the latest data, the average seller can expect a strong return on their investment when they make a move. ATTOM explains: “The $112,000 profit on median-priced home sales in 2022 represented a 51.4% return on investment compared to the original purchase price, up from 44.6% last year and from 32.8% in 2020.” Even though home prices have declined slightly in some markets, they’re still much higher overall than they were just a few years ago. To understand what’s happening with home prices in your area and the current value of your house, work with a local real estate professional. They can give you the best advice on how much you could gain if you sell this year. 2. My Home No Longer Meets My Needs The average person has been in their house for ten years. That’s a long time when you think about how much may have changed in your life since you moved in. And typically, those changes have a direct impact on what you need in a home. Whether it’s more (or less) space, different features, or a location closer to your work or loved ones, your current house may no longer check all the boxes of what feels like home to you. If that’s the case, it could be time to work with a real estate agent to find a better fit. Bottom Line If you’re thinking about selling your house, check out the The Secret of Wealthy Home Sellers! I'm here to give you the tools you need to make the most of your property.

- 7 Reasons to Own A Home

Welcome to the world of real estate! With Loni Lueke as your Realtor®, you can view a comprehensive selection of properties, whether you're looking to buy or sell. Plus, I will walk you through the seven reasons why homeownership is such an appealing option, including tax benefits, appreciation, equity, savings, predictability, freedom, and stability. 1. Tax Benefits The U.S. Tax Code lets you deduct the interest you pay on your mortgage, your property taxes, and some of the costs involved in buying a home. 2. Appreciation Historically, real estate has had a long-term, stable growth in value. In fact, median single-family existing-home sale prices have increased on average 5.2 percent each year from 1972 through 2014, according to the National Association of REALTORS®. The recent housing crisis has caused some to question the long-term value of real estate, but even in the most recent 10 years, which included quite a few very bad years for housing, values are still up 7.0 percent on a cumulative basis. In addition, the number of U.S. households is expected to rise 10 to15 percent over the next decade, creating continued high demand for housing. 3. Equity Money paid for rent is money that you’ll never see again, but mortgage payments let you build equity ownership interest in your home. 4. Savings Building equity in your home is a ready-made savings plan. And when you sell, you can generally take up to $250,000 ($500,000 for a married couple) as gain without owing any federal income tax. 5. Predictability Unlike rent, your fixed-rate mortgage payments don’t rise over the years so your housing costs may actually decline as you own the home longer. However, keep in mind that property taxes and insurance costs will likely increase. 6. Freedom The home is yours. You can decorate any way you want and choose the types of upgrades and new amenities that appeal to your lifestyle. 7. Stability Remaining in one neighborhood for several years allows you and your family time to build long-lasting relationships within the community. It also offers children the benefit of educational and social continuity. Interested in buying, but not sure of where to start? Don't worry! Check out The Do's and Don'ts in Your Home Buying Process! For More Information 843-505-1193 luekeloni@gmail.com www.lonigerman.com

- Who is The German Realtor®?

Hallo! I am Loni Lueke! Successful realtor in the Hilton Head Island and Bluffton area, originally from Germany "Loni Lueke is a successful realtor in the Hilton Head Island and Bluffton area, originally from Germany. She relocated to South Carolina in 2014 and has since established herself as a top real estate agent in the Lowcountry and Savannah area. Prior to her real estate career, Loni was a coach for managers, company leaders, and politicians. Her background in coaching has given her a unique skill set that allows her to understand and effectively communicate with her clients. She is known as the "German Realtor" in the area and has a reputation for being a reliable and professional agent. Loni takes pride in her ability to provide excellent customer service and strives to make every transaction as smooth and stress-free as possible for her clients." - ExP Realty Why Real Estate? Real Estate has always been an important part or my life and it was in Germany where I began my career. My past experience as a communication coach for designed CEO´s and politicians in Germany taught me that a relationship with open, trustworthy communication is the cornerstone for building a solid working foundation. Fort the last 25 years, I have taken this philosophy and immersed myself in the real estate market owning, purchasing, selling and remodeling homes throughout Germany, Portugal and the United States. In 2014, I made the decision to move from Berlin, Germany to the Hilton Head Island / Bluffton area, a decision I consider one of the best in my lifetime. I still love the area and the people, residents, and visitors! As a German I understand the European market and the expectations the people from overseas may have considering purchasing a second home or a permanent residence. I strive to highlight the lifestyle offered in real estate and the life quality offered in the Hilton Head Island/Bluffton area. In addition to working with clients from Europe I am passionate for uniting buyers and sellers for unique properties throughout the Lowcountry means that I am eager to serve the local market as well. Whether you are looking to purchase your first or second home or interested in owning a solid investment property, I will be there to guide you through the entire process and make sure you get the best deal possible!